Possible Destinations of Chinese Miners

Today, it is estimated that more than half of Bitcoin mining is clustered in China and it can be predicted that the balances in the mining industry will change drastically with China’s ban on cryptocurrency mining by a direct government decision on May 21. The move of miners may be one of the first results of these new decisions. In this article, we discussed the possible locations where Chinese miners can move their operations and the new Bitcoin mining investments in the North and South America Regions.

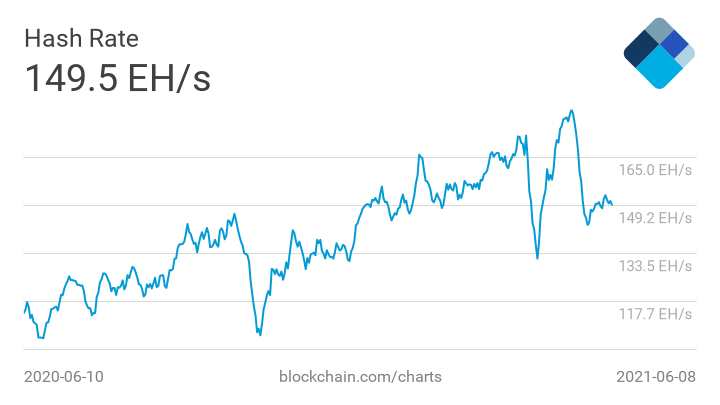

First of all, let’s summarize the situation in China: Although the facilities in regions such as Sichuan, where mining is carried out with renewable energy, were granted a work permit until September, it is observed that the miners who do not use renewable energy gradually stop their operations and start the relocation processes. For example, on June 9, the government of Changji, in the Xinjiang region, announced that it had informed the authorities to immediately cease mining activities in the Zhundong Economic and Technological Development Park, an important center for Bitcoin miners. The park was home to several mining companies operating on coal-based mining in the 15,500 square km area. A similar decision to shut down these operations was taken by the district administration of the Qinghai region on the same date. As the miners stopped their operations, the hash-rate in the Bitcoin network decreased, as seen below. The hash-rate is directly related to the number of active mining devices as it indicates the processor power in the network.

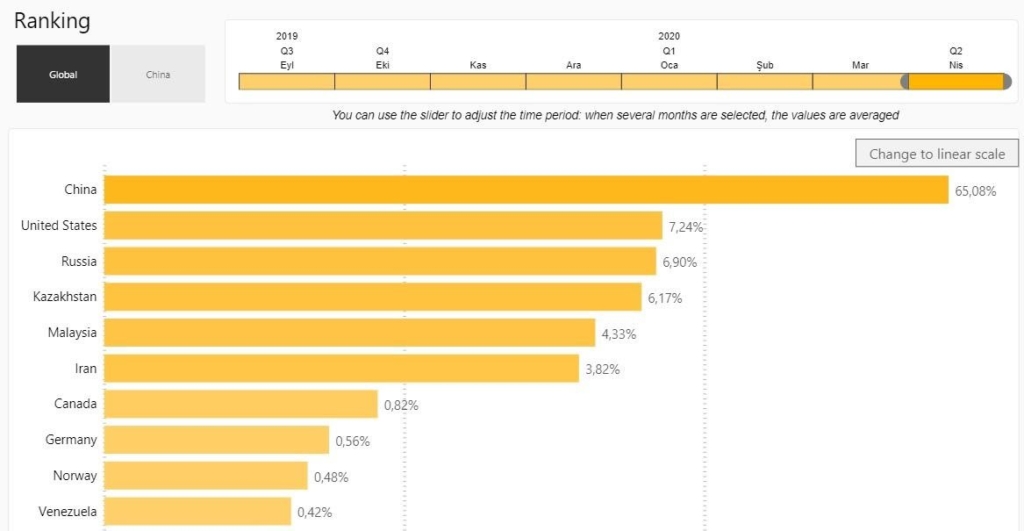

According to the Cambridge analysis below, which was last updated in April 2020, the USA, Russia, Kazakhstan, Malaysia, Iran, and Canada follow China in terms of Bitcoin mining in the world. If the data is updated, China’s share is expected to decrease, and the USA and Canada are expected to increase their shares. It is possible to understand the reason behind this estimate just by looking at the mining investments in 2021.

Where Will Be the New China in Bitcoin Mining?

The number of mining facilities concentrated in regions such as Texas, Georgia, and New York in the USA is increasing rapidly with the convenience of the legal infrastructure in these regions. US investors are strengthening their position in the country in case of the possibility of Chinese companies moving to the USA, with the investments they make after obtaining permits as far as they use “renewable energy”. However, the supply of mining devices has been a chronic problem for a long time for the companies waiting in line for months to obtain the devices they order, as manufacturers cannot keep up with demand. However, this situation may be reversed due to the unfavorable conditions of Chinese companies. Considering the fact that Chinese miners are trying to protect their existing investments instead of increasing them by ordering new devices, it is expected that these companies’ new device orders will be quite low. Hence, it is estimated that many mining companies, especially investors in the US, will receive their devices and start their operations in a much shorter time. One of the most important indicators supporting this view is the 2021 1st quarter report of the China-based Canaan company, one of the most popular device manufacturers. The company announced that, in terms of the device orders, the share of companies outside of China increased from 4.9% to 78.4% compared to the same period last year. In addition, it was stated that their revenues increased by 489% compared to last year. As is seen, not only almost all of the Canaan’s device sales have shifted abroad but also there has been a significant increase in the profit rate. This report is very important as it shows the aggressiveness of demand abroad and the inactivity of the Chinese market.

In short, it can be said that 2021 has become a very advantageous year for mining investment due to the ease of device supply, the provision of legal infrastructure, China’s negative view of mining, and rising expectations in the crypto market. Below you can see the highlights of the investments made in mining in various countries.

North America

- Canadian technology company Fortress Technologies has announced that it will invest in Great American Mining (GAM) by providing mining equipment worth $15 million.

GAM generates electricity by converting natural gas that is burned or cannot be used by releasing it into the air and uses this energy for Bitcoin mining.

Similar to GAM, the American company Upstream also operates in oil and natural gas extraction fields and produces effective and environmentally friendly solutions for Bitcoin mining by using the unusable energy normally released to nature.

- Riot Blockchain recently announced that it has acquired the world’s largest Bitcoin mining facility in Texas, which has changed hands several times before. The facility, which currently has a capacity of 300 MW, is planned to perform Bitcoin mining with 750 MW when it reaches its full capacity.

In addition to Texas, Riot Blockchain also mines Bitcoin with 16,464 devices in New York. The company has announced that it plans to purchase 58,500 more devices between July 2021 and December 2022.

- Blockcap announced that it aims to have a facility with a capacity of 32,000 devices in the Austin, Texas region ready by the following year. The company is currently mining Bitcoin with 10.000 devices.

- Pennsylvania-based Integrated Ventures has announced that it aims to start mining operations by the end of this year by purchasing 4,950 Bitcoin mining devices for 35 million USD.

- The ePIC company, which currently produces mining devices for Siacoin, has announced that it plans to produce mining devices suitable for the top 10 most valuable cryptocurrencies, especially Bitcoin.

- It is not known how soon ePIC will reach this goal, or even if it will. However, the production of mining devices in the US is highly important for the North American Region. This investment of the ePIC company may have important results to ensure the industrial independence of the USA and to have a practical infrastructure in device supply compared to the Chinese companies, which have almost a monopoly in the industry in terms of device production.

- Core Scientific, the largest blockchain service provider in North America, announced that it had signed an agreement with Bitmain to purchase 112,800 devices. With this agreement, Core Scientific has also become the only authorized service in North America for the repair of Bitmain devices. Following this deal, the company has doubled its mining facility in the Dakota, Georgia region, with three buildings under construction. In addition, Core Scientific states that all mining operations are powered by 100% renewable energy.

- Atlas Holding acquired the coal-based plant of Greenidge, a New York-based company. The facility has been closed for years as it could not cover its costs. After making the facility work primarily with natural gas, Atlas Holding started mining Bitcoin here with this energy.

- This investment is important in two ways. First, this is the first time a Bitcoin mining facility has its own energy source except for renewable energy. The second is the negative impact of this facility, which does not use renewable energy, on New York politics. Senator Kevin Parker has introduced a bill stating that cryptocurrency mining in the New York Territory should only be approved after a full audit. If the law is passed, only the facilities using renewable energy will be approved.

- Argo Blockchain announced that it had purchased 2 data centers powered entirely by hydroelectricity for Bitcoin mining in Quebec, Canada.

- Marathon Digital, together with Compute North, decided to establish a facility with 73,000-devices in Texas. It has been announced that the facility will be 70% environmentally friendly. Marathon Digital has another facility in Montana. However, this facility is not environmentally friendly. The power for the facility has been generated by the Hardin Generating Station in Montana, which generates electricity from coal, since the agreement signed in late 2020.

Marathon has received 10,000 devices in the first quarter of 2021 alone and announced that they aim to mine Bitcoin with a total of 100,000 devices by the end of 2022.

- Blockstream has also announced that they have made a deal with Square. According to this agreement, Square will invest $5 million in a solar-powered Bitcoin mining facility.

- Although the amount of investment is not high, this partnership has an interesting feature. The facility, which will be operated with the partnership of Blockstream and Square, has decided to publicly share all its costs and profits in a transparent and regular manner. Although it is possible to access data such as how much income mining companies earn thanks to on-chain data, this type of sharing can provide a much clearer and more comprehensive analysis of Bitcoin mining. Therefore, it is important whether this decision of Blockstream and Square will be adopted by other companies in the coming days.

- BIT Mining Limited, the owner of BTC.com which is one of the largest mining pools, announced that it will invest $25 million in a new facility to be established in Texas, which will run on 85% renewable energy, following an agreement signed with Dory Creek.

- Australia-based Iris Energy plans to nearly triple the size of its 9 MW mining facility in British Columbia, Canada, to 30 MW by the end of this year. The company has announced that it aims to become one of the leaders in Bitcoin mining by reaching 180 MW power in 2022.

- The HIVE company, which established facilities for Ethereum and Zcash mining in Iceland in 2017 and Sweden in 2018, preferred Canada for its new investment in 2020. The company has announced that it will make Bitcoin mining at the facility in Canada. The facility in Canada will be able to generate 30 MW of power. This amount shows that the new plant will use 6 times more energy than its plants in Sweden and Iceland combined. HIVE also states that all its facilities will use completely renewable energy.

- Besides HIVE, Kjell Inge Rokke’s (Norway’s second-richest person) energy company, Aker ASA, has established a subsidiary company called Seetee to invest in cryptocurrency and blockchain. Seetee has signed an agreement with Canada-based Blockstream for mining.

- These two investment news show that mining investments in Scandinavian countries are shifting towards North America. According to Deutsche Welle, the abundance of renewable energy in Scandinavian countries has begun to come to an end due to the development of heavy industry in these countries. The heavy industry’s need for renewable energy in production has resulted in the capacity of renewable energy sources in Scandinavian countries being filled. Therefore, mining investments in the cryptocurrency industry are shifting towards North American, as is seen in the case of HIVE and Seetee.

- The Bit-digital mining company has announced that Foundry has joined the mining pool with 5,679 devices. Bit-digital is actively mining Bitcoin with 40,000 devices as of March 31.

The Foundry mining pool is owned by Digital Currency Group, the owner of several companies including Coindesk, Grayscale, Genesis Trading.

The above-mentioned investment news about Bitcoin mining includes investments made after 2021, except for the Scandinavian countries. Besides the news shared here, many small-scale mining investments have also been made. As a result, it is clearly seen that North America is the new clustering area for Bitcoin miners. No matter how much the USA and China struggle with each other, the trade volumes of these two countries are quite large. Therefore, the decision of Chinese Bitcoin mining companies to move their operations to the USA in the near future should not be ignored. The fact that US investors are already trying to dominate the industry as much as possible shows that Chinese mining companies may have difficult times in competition.

Kazakhstan

Kazakhstan is another country that stands out among possible locations where Chinese miners can move their operations. Apart from the logistics advantage that Kazakhstan has due to its land border with China, Kazakhstan is a country that exports energy to neighboring countries. Kazakhstan’s rich energy resources ensure that energy is abundant and cheap in the country.

The state of Kazakhstan had pursued policies to ban cryptocurrencies until 2020. Since 2020, Kazakhstan’s state policy has changed positively regarding cryptocurrency, and mining activities have been recognized as a legal industry. Then, special tax incentives for cryptocurrency mining were introduced. Official authorities have also announced that the country plans to generate significant revenue from cryptocurrency mining, signaling that positive policies will continue.

Unlike the companies in North America, Kazakhstan does not offer renewable energy to Bitcoin miners. The country’s cheap electricity is generally generated from coal. In the city of Ekibastuz, close to the Russian border, there is an operating cryptocurrency mining facility with a capacity of 50.000 devices. Major recent investments in Kazakhstan are listed below.

- The BIT Mining company has announced that it has invested $9.3 million for the establishment of a 100 MW Bitcoin mining facility in partnership with a local company in Kazakhstan.

- The Chinese company Canaan, one of the most popular mining device manufacturers with Bitmain, decided to establish a headquarters in Kazakhstan on June 7. The headquarters to be established will serve for the maintenance and repair of devices. In addition, according to Reuters, Canaan plans to establish its own mining facilities in Kazakhstan.

- The news by Reuters is just a claim, but the news about the company opening a headquarters in Kazakhstan for the maintenance and repair of devices is confirmed. Based on this news, it can be assumed that the Canaan company expects Bitcoin miners to shift towards Kazakhstan. This move of Canaan is a very important signal, as it is one of the most important device manufacturers in the industry. Hence, the probability of Chinese miners moving their operations to Kazakhstan increases.

South America

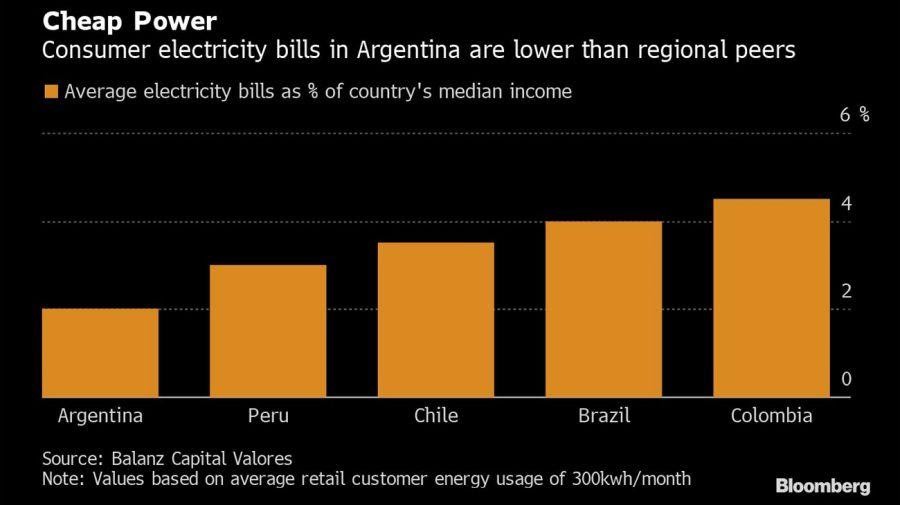

Throughout history, South American countries have been frequently mentioned with political instability and the economic crises that emerged as a result of the turmoil. Today, Argentina, while still struggling with economic difficulties, attracts the attention of cryptocurrency mining companies due to the cheap electricity it offers, as well as being prominent in the use of Bitcoin due to the serious depreciation of the peso. The depreciation of the Argentine Peso against the USD has resulted in electricity becoming cheaper, especially for foreign investors. Although the price of Bitcoin has dropped to around $30,000, the electricity cost is only around 2–3% compared to the income from mining. This increases the profit margin considerably. The chart below shows the average electricity bills of countries in South America as a percentage of their revenue. Argentina attracts the attention of Bitcoin miners as a country with the lowest electricity cost compared to income.

There is no doubt that the economy of Argentina will recover soon or later. Therefore, companies that want to take advantage of the current situation are willing to sign a long-term electricity purchase agreement with fixed costs at current prices.

- Canadian cryptocurrency mining firm Bitfarm LTD. has signed an 8-year contract with an Argentine energy supplier. Thanks to this agreement, Bitfarm will be mining Bitcoin with 55.000 devices in the Patagonia region and will be able to procure electricity at a fixed price for 8 years.

El Salvador gains stream to become another popular country in South America for the Bitcoin community and mining companies. Officially accepting Bitcoin as one of the country’s official currencies, El Salvador has also announced that Bitcoin mining facilities will be established using renewable energy, thanks to its rich geothermal resources. After this statement announced on the president’s Twitter account, it can be expected that mining companies abroad will decide to invest in El Salvador to benefit from geothermal energy.

More Decentralization, More Control

Along with the rise in the cryptocurrency market, the mining industry seems to have witnessed an aggressive investment frenzy due to the high profitability rates it promises. All miners compete with each other to get the reward from each Bitcoin block. Therefore, as the proportion of Chinese miners in the network decreases, other miners will see an increase in their income. The reason for the demand for Bitcoin mining has been consistently high for years is that money spent on facilities and devices quickly pays off as Bitcoin rise in value. The mining industry, which returns the investment in a short time, provides a long-term investment opportunity as well as fast profits. The renewable energy-oriented growth of the industry is very beneficial in terms of environmental protection and it enables countries such as the USA and Canada to minimize their cost disadvantage against countries that provide cheap electricity such as China, Kazakhstan, and Argentina. In addition, considering the fact that many mining companies have their own mining pools, it may be possible that pools operating with renewable energy may be preferred more by nature-conscious people. Therefore, in the future, it seems likely that there will be a separation in the industry as miners using nonrenewable and renewable energy.

Apart from all these factors, Bitcoin mining has another important benefit: Since the miners enable the extraction of Bitcoins in previously unused reserves, the transfer data of these Bitcoins are empty, in other words, clean. Hence, buying Bitcoin directly from the miner and buying Bitcoin purchased from anywhere else are actually different. No matter how fast the adaptation process to cryptocurrencies progresses, the anonymity provided by blockchain technology still disturbs the financial authorities of many countries on issues such as the use of cryptocurrencies for tax evasion and money laundering. Since every transaction on the blockchain is public, tax authorities and regulatory authorities are working on softwares that can track suspicious transactions. Since the transfer data of the Bitcoins produced by Bitcoin miners are also clean, it is much easier for these institutions to track the newly produced Bitcoin directly by adding them to their systems. As a result, the increasing dominance of countries such as the USA and Canada while are Bitcoin miners moving out of China may be pleasing for the regulatory authorities of these states.

2021 has the potential to be a golden year for both the growth of mining facilities and the increasing decentralization of cryptocurrencies. However, in the following years, we may see an increase in more effective and tighter tax controls on cryptocurrencies and money pursuits on suspicion of crime due to the reasons mentioned above.

Written By: Berkay Aybey

The opinions and comments expressed here belong to BV Crypto. BV Crypto cannot be held responsible for any financial transactions made on the basis of this post. Every investment and trading move involves risk. When making your decision, you should do your own research.