UAE IS ON TRACK TO BECOME A CRYPTO HUB

New sectors forming around the crypto market, lobby power, increasing interest of the public and investors grow stronger day by day, creating new value for every segment. While interest towards the market means a potential vote and lobby power for a politician, it may mean discovering the opportunity of a new Google or Facebook for the corporate investor and financial freedom for the public. Since cryptocurrencies allow the financialization of any digital asset, the generated value variety makes it possible to create new values that were not noticed before. Therefore, cryptocurrencies that reach more people every day are seen as a potential threat to the existing system by regulators and central banks; the size of the economic and social opportunities have become non-negligible. As a result, two distinct groups see cryptocurrencies as an opportunity and a threat, just as in any innovative development. Our article will focus on the United Arab Emirates (UAE), which sees cryptocurrencies as an opportunity and declares to become a global center in this field and examine the blockchain-cryptocurrency-based ecosystem.

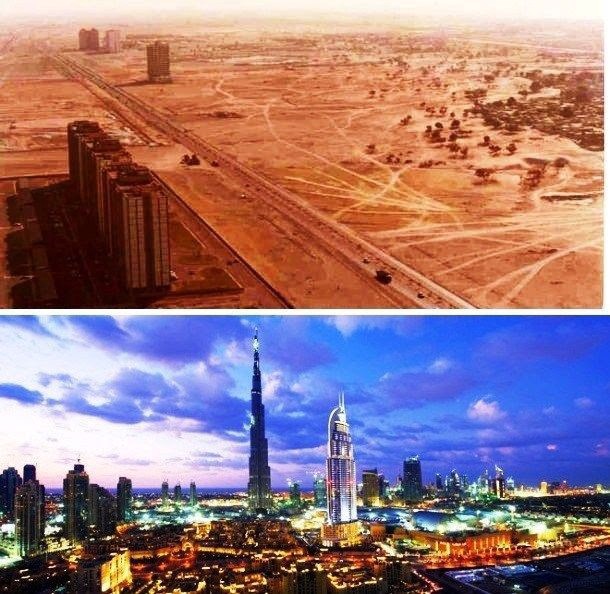

United Arab Emirates’ Short History

It will be useful to check the summary of the country’s history before skipping to UAE’s policies regarding cryptocurrency and blockchain. Like many other countries in Arabia, UAE’s economic development stems from rich petrol and natural gas sources. While UAE declared independence from UK in 1970 and had underground resources that were the prime source of the development, the rapid development in a short span of 40 years was due to the founding of the world-famous Dubai, Abu Dhabi cities. However, it would not be appropriate to associate the UAE’s entire success with the underground resources, as it becomes a global financial center.

In the 70s, Dubai was stationed at the center of the trade intersection formed between Iran, East Africa, and South India. The majority of the trade was conducted with Iran. Hesitant trade activities resulting from political movements in Iran negatively affected Dubai. After the collapse of the Soviet Union, the increase in trade between Russia and Dubai enabled the country to grow its prosperity again. The tourism and service sector were prioritized to minimize the effects caused by the change of conjecture on the country’s trade. For this purpose, starting from the financial field, investments and incentives to innovation were increased. Especially with the popularization of media and internet companies, zero tax private space has been allocated to these sectors. In short, as a result of incentives related to innovation, Dubai has become a frequent visiting place for foreign investors and hot money.

Government Policies

Dubai-based cryptocurrency policies of UAE have started as blockchain technology-based. Once a centralized control mechanism controls blockchain technology, it might lose advantages to existing systems. However, depending on the installed system, it might still benefit security and speed. The government’s policies towards blockchain technology include plans to improve security and efficiency.

We can summarize the steps made in the past three years as:

- In April 2018, the UAE government announced ‘Blockchain 2021’. The document emphasized the increased focus on the happiness of people in the country, the government’s effectiveness, advanced regulations, and global initiatives. The ultimate goal was becoming the first government to process all services from blockchain technology.

- In September 2018, DubaiPay, which both official institutions and private businesses used to receive payment, aimed to increase the processes’ effectiveness and speed by reinforcing its background with blockchain integration.

- DMCC, founded in 2002 with the government’s help to strengthen commodity trade, allowed Indian farmers to directly market their goods in the Dubai market by creating a blockchain-based agricultural trade platform. Therefore, DMCC removed the middlemen and reduced the costs. At the same time, due to the agricultural disadvantage of the country, it also contributed to the very crucial food safety.

- DMCC also announced that once permitted by the country’s securities and commodity regulators, planning to install a Crypto Valley similar to the Silicon Valley. DMCC announced that cooperation was made with the Swiss-based CV VC for this aim. Crypto valley will be a tax-free zone and in addition to establishments, education and mentorship services for those aiming to make a career in this field and business incubators for start-up projects have been planned.

- Serving as UAE Ministry of Economy until July 2020, Abdulla Bin Touq Al Marrihas expressed in his speech at World Economic Forum that they have focused on finance and service economy to be freed from petroleum-dependent economy and therefore focused on the digital economy and tokenization.

- During the minister’s speech, the emphasis on the digital economy can be directly associated with cryptocurrencies. Typically, tokenization is not a frequently expressed topic by the experts. In other statements made by the authorized institutions about regulations mentioning tokenization indicates the interest of the UAE in this field. Tokenization may be used notably by Dubai to attract hot money and people from various nations to come to UAE and to ease investment. For example, real estate tokenization could be an ideal way of purchasing real estate without visiting the UAE.

- Minister also stated that tokenization subject is crucial for the country to catch pre-pandemic levels, and small businesses could be indebted through tokens. Tokenization could work as a bond-like debt instrument. This is giving an excellent example of UAE’s pro-innovation policies to attract investors continuously.

- By the end of October 2021, Dubai’s financial regulator DFSA has published a statement clarifying digital properties. We also see that regulators arrange directives supporting the sector within the digital property-friendly policies framework.

Private Sector

Since the projects actualized with the government’s help to create an ecosystem will not be adequate in a country, the healthiest ecosystem is created by the private sector competing with one another within the framework of the free market rules through the background formed by the government. Above, we have checked what the government made steps in UAE. In this process, the private sector, primarily actions made by the banks, constitute an essential role. We can summarize developments for this subject as follows:

- Canada-based 3iQ Company, which holds 1.5 billion USD under its administration, has applied to Nasdaq Dubai Stock Exchange to present a BTC-based product under Bitcoin Fund that appeals to corporate investors. After the regulator’s permit, the product was listed on the stock exchange.

- Dubai-based cryptocurrency market BitOasis has received investment in B series investment tour by Digital Currency Group (DCG), NXMH, Pantera Capital, and Alameda Research companies.

When we take a closer look at these companies:

- DCG is the owner of Grayscale, Coindesk, Genesis, Foundry, Luno that are pioneers of the sector.

- While NXMH becomes prominent as the owner of the Bitstamp exchange.

- Alameda Research is a sub-company of the FTX market.

- Pantera Capital is the most prestigious and comprehensive fund management company that invests in crypto.

As a result, Dubai’s cryptocurrency-friendly policies allow foreign investors to come to Dubai and enable local companies to receive investment easily.

- Dubai’s biggest bank Emirates NBD has developed blockchain-based software to prevent fraud attempts in cheque trade.

- Led by Emirates NBD and compatible with central bank directives, a blockchain-based KYC system was prepared. Integration of other banks to this system is also expected.

- Government based Mubadala fund has announced to make cryptocurrency investments. There are 243 billion USD under the fund’s administration.

- A company named The Asset Advisor has started selling real estate for cryptocurrency.

Dubai World Trade Center and Binance

Starting from Dubai, the latest development in the cryptocurrency and blockchain sector through the UAE government and private sector is probably one of the most important developments. Cryptocurrency market Binance had a very stressful year after receiving stern warnings from the regulators of various countries. Experiencing legal problems due to not having a headquarter for the exchange had caused services to stop functioning temporarily or permanently in various countries. CEO of Binance CZ had admitted to having faulty aggressive expansion policies and started cooperating with regulators. While trying to find various solutions to the topic, Binance prioritized hiring people with good relations with regulators and reinforced lobbying activities. As for countries experiencing issues with the activities, local crypto exchanges were purchased.

The epicenter of the problem stems from Binance not having a headquarter, and sooner or later, it has to choose a country. Once the tax amount paid by billions of dollars’ worth exchange is considered, the market’s decision has gradually become more critical. In the end, with the tax incentives, France and Ireland have become the most prominent candidate countries for the headquarter of Binance.

On December 21, the goodwill agreement signed between Binance and Dubai World Trade Center (Dubai WTC) sets forth Binance’s regulation and prevention of money laundering by guiding Dubai WTC through and helping during the operation of cryptocurrency markets and licensing processes. CEO of Binance CZ’s meeting with both Dubai and Abu Dhabi regulators and purchasing a house from Dubai can be interpreted as opening a headquarter in UAE. In the country’s short history, once the zero tax policies and importance towards innovation other than petroleum kept in mind, it can be guessed that UAE might not hold back against giving similar incentives to invite Binance into the country.

Conclusion

As mentioned at the beginning of the article, there are always two opposing groups for and against in every innovative development. To which degree the innovation is needed will not change by how strong the arguments of these groups are or how much supported by the strong lobbies. If innovation is required and needed, it reaches its value sooner or later. There are always some people who oppose the simplest technological tool to the most complex one. From the current standpoint, once the success of cryptocurrencies in 12–13 years is examined, the questions regarding whether this innovation is needed or not become meaningless every single day. Therefore, it can be guessed that the countries benefiting from opportunities created by cryptocurrencies in every field, and protecting their citizens from potential dangers, will show a higher development than other countries. It is never too late to enter and learn cryptocurrency market. However, this rule may not apply to countries.

Prepared By: Berkay Aybey

The opinions and comments expressed here belong to BV Crypto. BV Crypto cannot be held responsible for any financial transactions made on the basis of this post. Every investment and trading move involves risk. When making your decision, you should do your own research.

Berkay Aybey

Business Analyst