Importance of Standards and Impact on DeFi

Last March, a new token standard called ERC-4626 was approved and integrated into the Ethereum network. The token standard is the ready-made delivery of the ideal form of various encodings, such as the creation, proper functioning, and integration of a token into the network. In this way, developers save time.

Token standards are very important because they have a great impact on the cryptocurrency market to create new sectors. In this article, we will first discuss why it is important for an industry to have standards, and then after evaluating this issue in DeFi, we will exemplify the issue by looking at what the tokens in the ERC-4626 form mean. Enjoy your reading.

Checkpoint

A person known as a standard person means that they are ordinary, which has a negative meaning. Although this has a similar meaning for sectors, it does mean something positive. The standards introduced in the sector allow the previously irregularly functioning system to become ordinary by getting into order, which stabilizes the sector. The sector, which continues to operate in a stable manner, is considered reliable.

Although the cryptocurrency market has grown incredibly quickly for those in it, the market, which has only a 13-year history, still has many points to prove itself and reassure. The DeFi (Decentralized Finance) sector, which we can define as cryptocurrency banking, is one of the areas that should give confidence. Although there are many reassuring DeFi platforms that work very stable and successfully, it is difficult to say that this reliability and healthy flow can be seen, especially on newly established platforms. DeFi platforms, which are expected to become more stable and reliable as time goes by, unfortunately, began to come up with more hacking events as time went on. One of the most important consequences of this can be said that the capital in the market is stored on stable functioning platforms and giantizes these platforms. Although the interest received by such healthy functioning platforms is positive in terms of rewarding success, the main thing to mention in a healthy market is that the DeFi sector has become stable and reliable in every sense. In this way, competition can be more healthily functioning across the platform.

Looking at the current outlook, we often see that new DeFi platforms that want to take a share of the giant platforms are trying to attract demand by giving higher return rates and adding different functions. This trial-and-error process also appears to have taken on dangerous dimensions from time to time, resulting in record amounts of hacking. Therefore, although the competition is aggressive, it can be noted that the safety standards do not work well due to poor security standards by some platforms or coding errors.

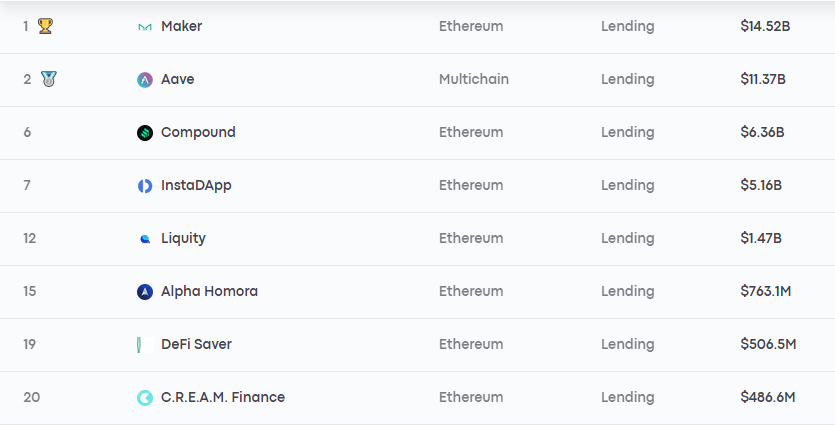

As an example of the current competitive situation; The column on the far-right side of the table below shows the cryptocurrency sizes locked into the lender’s platforms. In the table, it is seen that the top 4 platforms have most of the capital in the market, while the platforms afterward receive relatively low shares.

Although the trial-and-error process is extremely important for the sector to go further, it is extremely important to be done based on certain safety criteria, in terms of stabilization and ordinary. Token standards enable DeFi platforms that perform complex transactions with smart contracts to easily reach the ultimate possible solution up to a certain level.

For example, suppose the developers of each DeFi platform score between 1–10 on the system they set up when programming the token for their platform. Rank 1–4 as the most insecure, 4–7 as the intermediate level, and 7–10 as the best token. For reasons that depend on the capabilities of the developers, the financial means, and the time they have, each platform’s own token will be of different scores. With the advent of the token standard, developers can avoid making at least basic mistakes, starting directly from level 4, saving time lost by researching processes 1–4 and finding the best, and saving money because it saves time. Token standards, therefore, serve as a kind of new checkpoint.

Selectivity of Demand

DeFi users who do not know about the software and cannot examine the codes, that is, the majority of users, if they want low risk, use known DeFi platforms, high risk, and high return prefers newly installed platforms.

The fact that even 1–2 of the 100 newly installed platforms have been hacked makes new platforms unsafe for users. Therefore, it is obvious that the user will request platforms that are above a certain level of security, regardless of the level of risk they prefer. Token standards provide a certain level of interaction for these tokens both within their own platforms and with other platforms. In this way, users are not allowed to request platforms below this level. If we continue from the example in the previous topic, it can be considered as the fact that platforms below level 4 are not preferred no matter how high returns they offer. Therefore, the introduction of such technical standards makes this situation ordinary as it forces platforms to rise above a certain level and leads to the selectivity of the user’s demand in this direction.

ERC-4626

DeFi platforms, which lend for collateral, offer interest income in exchange for users locking their assets into the platform. A new token, which also represents the interest income you receive for the asset locked to the platform, is defined to the user by the platform. For example, if you lock your ETH assets to the Aave platform, you will receive the aETH token that represents your asset+interest income.

The interest rate of the platforms rises or decreases according to the platform’s balance. Some platforms set up a separate pool, a vault, which automatically selects the most suitable platform, as there are many platforms that give interest. To do this, they also need to integrate aETH-style tokens, as in the case of Aave.

ERC-4626 provides standardization of aETH-like tokens representing asset+interest income. That is the standardization of tokens that represent interest income. Thanks to this standard, the integration of DeFi platforms into interest-giving platforms such as Aave is intended to be much faster. Instead of developers working separately to integrate the token of each platform, it can be said that shortening the time spent during integration is the main goal, with each platform complying with the ERC-4626 standard.

In this sense, the platform that took the first step was Yearn Finance. It is possible for other platforms to follow a similar path in the future. In addition, blockchain networks such as BNB Chain or Tron can be expected to start using a similar token standard by DeFi platforms on these networks, as they copy such token standards from the Ethereum network to their own networks.

Maybe It’s Not an NFT But…

Token standards such as ERC-721, and ERC-1155 can lead to the formation of an industry such as NFT and the reality of a dream-like metaverse. The ERC-4626 standard may not be an NFT, but as mentioned throughout the article, it is extremely important to standardize the sector with such steps, small or large. The fact that DeFi platforms offer above a certain level in every field they serve is one of the most important building blocks for the sector to achieve a stable uptrend.

Prepared By: Berkay Aybey

The opinions and comments expressed here belong to BV Crypto. BV Crypto cannot be held responsible for any financial transactions made on the basis of this post. Every investment and trading move involves risk. When making your decision, you should do your own research.