Constructive Criticism of Cryptocurrencies by IMF

The 2022 issue of the Global Financial Stabilization Report (GFSR), which is published by the IMF regularly every year, covers the cryptocurrency sector in a separate section while interpreting the global economic situation. The report addresses issues ranging from the IMF’s ‘cryptoization’ (beginning to prefer cryptocurrencies instead of national currencies) risk to CBDCs, from regulations to the DeFi platforms. It can be stated that IMF expresses an innovative and positive opinion on cryptocurrencies in general and its biggest reservations about the market are the problems experienced about regulation.

In this article, after briefly including the IMF’s views on the global economy, we will focus on the sections of the report discussing cryptocurrency and examine the tips, opinions, and comments that the IMF has clearly stated and shared between the lines. We wish you happy reading.

Winners and Losers of the War

Before discussing cryptocurrencies, a brief review of the IMF’s comments on the global economy will reinforce the basis of the views in the cryptocurrency section. The IMF states that central banks were about to enter a period of normalization after the monetary expansion policies reached an advanced stage due to the coronavirus before the war, but the war slowed down this transition process. The central banks, which did not want to deal with the inflation monster created by monetary expansion, continued their normalization policies despite the war. It was observed that the currencies of advanced economies strengthened particularly in this period. The fact that the war raised commodity prices, threatened energy security, and strengthened the currencies of advanced economies directly affected emerging economies negatively.

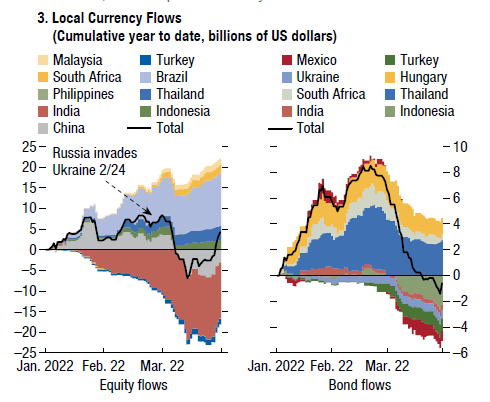

The charts above indicate how much capital emerging economies lost after the war. The chart on the left indicates that India, China, and Turkey experienced the biggest loss in terms of equity, while the chart on the right emphasizes that Mexico, Turkey, and

Indonesia experienced the biggest loss in terms of bonds. On the other hand, Brazil takes the lead among the winners of this period. The price increases in commodities due to the sanctions imposed on Russia have resulted in an increase in cash inflows to Brazil, which exports commodities in this field. However, in general, it can be stated that investors have been withdrawing their money from emerging economies and moving to advanced economies that they consider safe-havens. This caused the inflationary approach observed all over the world to be felt more severely in emerging economies. The meltdown in the purchasing power of the people has significantly increased interest in alternative markets such as cryptocurrencies.

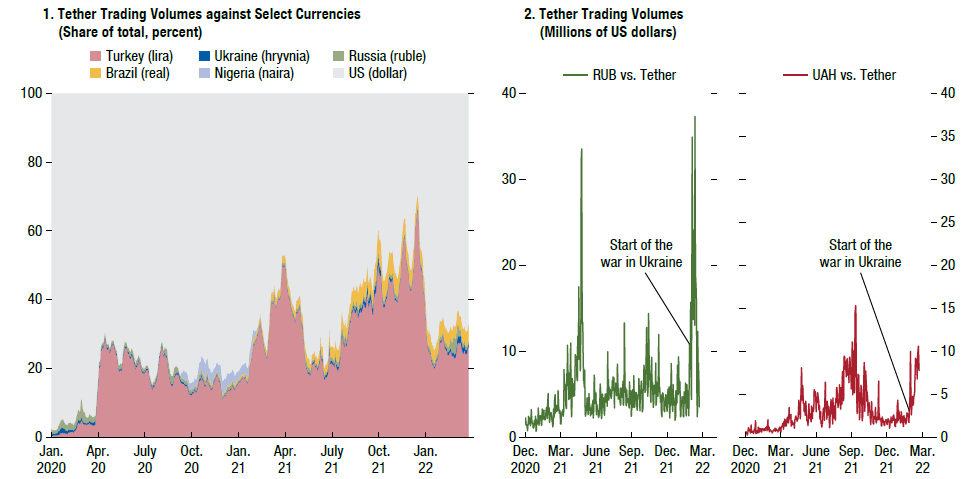

Among these two charts generated by the IMF only on Tether (USDT) data, the left chart reveals the increase in the use of USDT by countries, while the right chart examines the same change in Russia and Ukraine. While Turkey, which is displayed in pink on the left chart, is observed to be by far ahead in the increase in the USDT volume, it can be stated that the increase in Brazil is also remarkable. The fact that the left chart does not decline below 20% for a while indicates that the current use of USDT can become permanent, which supports the situation regarded as cryptoization by the IMF. Considering the chart on the right, a stable process cannot be mentioned, although there are significant increases in the use of USDT in both Ukraine and Russia in certain periods due to the war.

Recommendations to Policy Makers

The IMF mentions 3 major topics that policy-makers should pay particular attention to after the war.

1- Negative Impact of Energy Security Strategies on the Global Climate

In this section, it can be thought that the IMF has estimated that particularly European countries and those dependent on energy imported from Russia will abandon strategies such as “zero carbon emissions” and “stopping the use of fossil fuels” due to the sanctions on Russia. Therefore, international cooperation in the field of energy, including fossil fuels, can also increase.

In this period, it can be expected that politicians’ criticism of Bitcoin mining will increase to reduce the public reaction that may occur due to leaving aside the environmental policies.

2- Increased Vulnerability in the Global Markets and Its Effects on Dollar

It can be stated that the main issue mentioned in this section is the global fragmentation that started with the blocking of the USD and EURO reserves in the Russian Central Bank. The IMF states that this fragmentation is also supported by the fact that most countries do not have a regulation on cryptocurrency, and it directly targets cryptocurrency miners. Since even ‘know your customer’(KYC) data are not collected in some countries and it is difficult to track cryptocurrencies using mechanisms such as mixers, it is stated that countries both get rid of sanctions and earn additional cryptocurrency revenues through mining. For example, it is indicated that BTC miners earned USD 1.2 billion per month in 2021 while 11% of them are Russian-based miners and 3% are Iranian-based miners. In addition to this example of the IMF, it should be noted that the Iranian government directly purchases the BTCs mined by miners in the country and uses it in trade. To conclude, the IMF advises policy-makers to pay attention to cryptocurrency miners.

3- Increased Vulnerability in Payment Systems

This process, which started with the prohibition of Russian citizens from using Mastercard and Visa cards outside Russia, should be examined together with the blocking of the reserves of the Russian Central Bank, which is mentioned in the previous section.

The IMF states that the loss of confidence in the USD and payment systems resulted in an interest in alternative systems. It is underlined that there are few alternatives other than SWIFT in the current system, and even China’s own money transfer system, CIPS, is partially dependent on SWIFT. Therefore, it is pointed out that central banks are in a global competition to develop their own digital currencies (CBDC). The IMF points out that CBDC developments can reduce the risk of cryptoization. That is, if central banks provide the efficiency and cheapness offered by cryptocurrencies through the CBDCs, it is assumed that people will not use cryptocurrencies at least for money transfers. On the other hand, the IMF assumes that it will be difficult to establish a common system because each central bank will develop a separate CBDC system. Indeed, we have to acknowledge the IMF to be right since each central bank uses a different system and a different blockchain network. Therefore, the IMF warns policymakers that there may be fragmentation in payment systems in the future due to CBDCs or alternative systems to SWIFT.

As can be seen in the second and third issues, the IMF thinks that cryptocurrency-based systems can have a serious impact on the global economy. Considering the charts in the first part of the article, it can be stated that particularly the people in the emerging economies have already begun to adapt to this kind of transition.

(You can also review our previous article titled ‘Possible Effects of the Ukrainian War on the Status of Bitcoin and the Global Economy’ on the new economic model that may occur after the war.)

Fintech

A large part of the report is devoted to innovative financial solutions, i.e., the fintech sector. The IMF’s concern with fintech is that these companies, which provide banking services, can somehow get rid of strict regulations and bear high risks because they do not have a bank status. The «manageable risk» born by the fintech sector seems to have become dangerous in the eyes of the IMF, as the global economy has experienced consecutive shocks, both due to the Covid pandemic and the war. Therefore, the IMF, which proposes to pay attention to the risk appetite in the fintech sector and to introduce stricter regulations while not interfering with innovation, also addresses the decentralized finance (DeFi) platforms in this section. When it comes to regulatory problems and innovative finance, the DeFi platforms would likely come to mind. However, contrary to popular belief, considering the charts, IMF is observed to have quite positive analyses and expectations for DeFi.

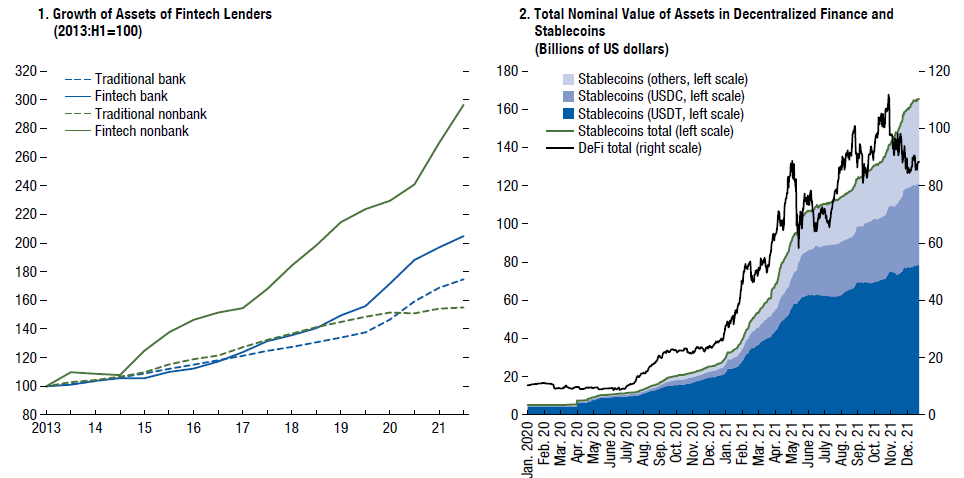

In the chart on the left, the IMF divided the fintech sector into the firms with and without bank status and shows sectoral growth by comparing it to the traditional economy. According to this chart, fintech firms with bank status have doubled their growth since 2013, while traditional banks have a growth of almost 80%. The striking point is that the fintech firms that do not have a bank status have grown three folds since 2013, leaving other sectors behind. Rapid growth in this sector, which has relatively softer regulations, can be regarded as the source of the IMF’s concerns stated in the report. DeFi platforms are also among the fintech firms that do not have bank status. Considering the green curve at the top, it can be estimated that the biggest share in the sharp rise after 2021 belongs to the DeFi platforms.

The chart on the right reveals that stablecoins have reached a total market value of around USD 160 billion, and USD 85 billion of this amount is on the DeFi platforms. The IMF lays out a positive roadmap about the DeFi platforms and states that the rapid growth observed in the last 2 years can continue, the potential of the sector is high due to the cooperation of DeFi platforms with the actors in the traditional economy. The loans given by MakerDAO and Aave as a result of their deals with companies outside the cryptocurrency market can be shown as an example of the cooperation pointed out by the IMF.

Decentralization Stalemate

The report includes a separate section about the risks faced by banks while competing with fintech firms. The section under this heading on how banks will keep pace with fintech firms is quite important since it implicitly emphasizes decentralization. The IMF states that banks often follow the method of integrating technological developments into their systems by acquiring fintech firms, noting the risks posed by this phase. The IMF’s biggest fear is that banks use a common service providers at the end of this process, which brings about a new technological adaptation. The IMF states that a cyber attack on the common mechanism or a power outage could cause great damage in such a case and recommends some form of decentralization.

Based on the above opinions of the IMF, it seems possible that decentralization will be embraced by the IMF in the first place once a consensus is reached on how to regulate the decentralized platforms exactly.

Emphasis on Imbalance

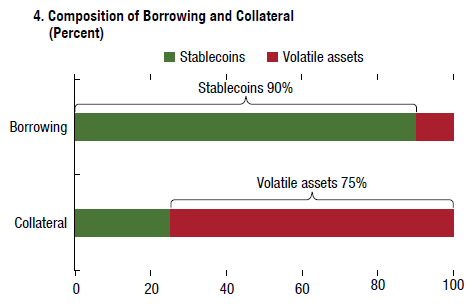

Although the IMF indicates DeFi platforms among the risk factors to be considered in the report, it also includes various significant positive comments. The following chart is important in that it shows the IMF’s emphasis on the imbalance in the DeFi platforms. Although the imbalance is not explicitly mentioned in the report, it can be estimated that generating this chart aims for this.

The chart above shows that cryptocurrencies are used for 75% of collateral for receiving loans on the DeFi platforms and that 90% of the loans are demanded in stablecoins. Considering the purpose of founding these platforms, this type of imbalance is quite normal. Because the initial purpose of platforms is to meet the cash needs of the users without selling their cryptocurrency investments. Ratios show that platforms are successful considering this purpose. However, these ratios also indicate that the DeFi platforms have a uni-directional operation. As it is known, most investors take a loan in stablecoins by collateralizing the cryptocurrency in their balance when the market rises. They increase their investment amount by buying cryptocurrency again using the loan received. It is also possible to repeat this cycle by collateralizing the purchased cryptocurrencies again. However, this is only profitable when the market rises. Therefore, the above ratios indicate that the lending mechanisms of the DeFi platforms are not very effective when the market declines. In other words, if investors were to collateralize their stablecoins to take loans in cryptocurrencies and seek to profit in a downside market where they make more stablecoins by selling the cryptocurrencies they bought while the market was declining, the above ratios could have a more balanced state.

The above graphic, which the IMF indicates among the risks it criticizes, is also important in terms of showing the potential of the DeFi platforms. Platforms can have a more profitable and sustainable business model if they continue to lend in cases when the market rises or declines.

Promotion of DeFi by the IMF

The section, in which DeFi platforms are compared with other segments of the fintech sectors in terms of various fields, serves as an incentive for establishing a DeFi platform or investing in it. This case, which we will examine on three separate charts below, clearly reveals how new DeFi platforms are advantageous in the field of fintech.

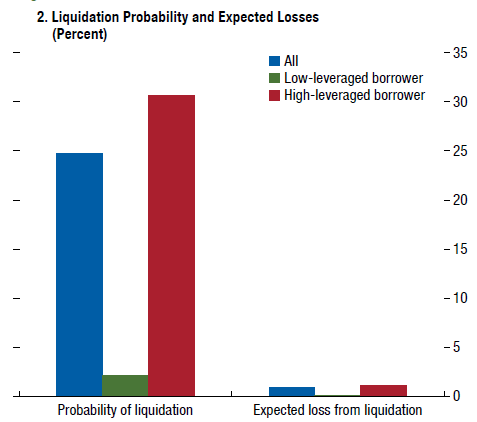

The chart above examines the amount of loss to be incurred in case of not paying off the loans given by the DeFi platforms. The red bar among the three bars on the left refers to high-risk loans, i.e., the loans where the collateral for the loan is just above the required collateral amount. The green bar refers to the loans for which the given collateral easily pays the loan. Therefore, loans with low collateral (red) are highly likely to be liquidated. The blue bar indicates the total liquidation risk and represents a high value.

Considering the three bars on the right, it is noteworthy that even if the high-risk loans are not paid off, the loss to be encountered is quite minimal. This is because banks or bank-like fintech firms can lend without collateral. Since the DeFi platforms use the collateral mechanism, it minimizes the loss caused by the loans, allowing the platforms to continue their activities easily if the loans are not paid off. Now, let us move on to the chart below keeping in mind this information.

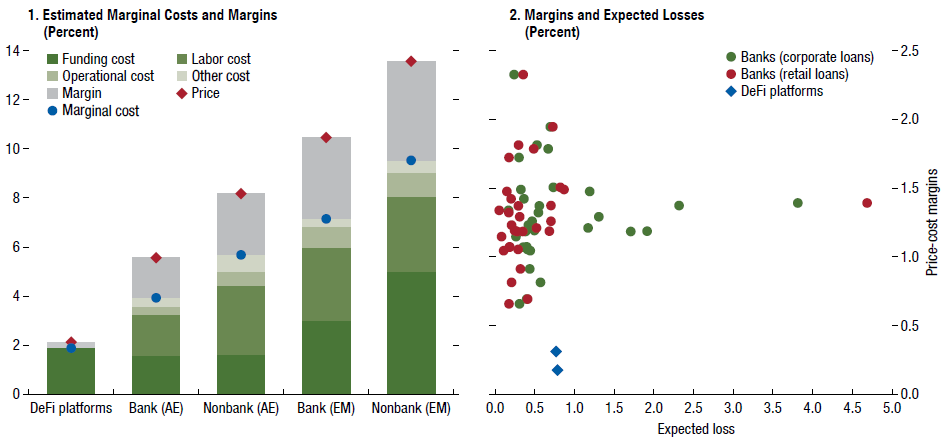

With the chart on the left, the IMF compares the costs of the DeFi platforms and finance firms with or without bank status. In the chart, the companies with code AE in parentheses represent the companies in advanced economies, while those with code EM represent the companies in emerging economies.

At first glance at the chart, it can be seen that the DeFi platforms offer the lowest total cost. The fact that the items called labor costs, operational costs, and other costs, which are significant cost items in other companies, are not one of items for the DeFi platforms causes this difference. In other words, the absence of physical branches and hundreds and thousands of employees is one of the biggest advantages. The ‘funding cost’ is a common cost item. Following the provision of liquidity on the platform, the DeFi platforms seem to automatically operate and overtake banks and other fintech companies.

The chart on the right actually examines the credit risks that we already examined using the previous chart by comparing DeFi platforms with firms with and without bank status. The blue dots in the chart represent the credit risks of the DeFi platforms. Considering the blue dots, it is seen that the expected loss of the DeFi platforms if the loans are not paid off is slightly higher than that of the banks in general. However, the main point to be considered here is that the cost items that banks bear while giving loans are much higher than those of the DeFi platforms. Therefore, the blue dots at the bottom show that the DeFi platforms stand out as the lending system with the least cost, and the risk of not paying off is higher than that of the banks by a quite small percentage ranging between 0.3% — 0.5%.

To conclude, it is quite clear that the most reasonable action for an entrepreneur who wants to establish a fintech company to start with the least cost is to establish a DeFi platform.

— — — — — — — — — — — — —

Although the IMF adopted an anti-cryptocurrency attitude in its agreement with Argentina and constantly drew attention to the risk of cryptoization, it showed that it had positive expectations for DeFi, which is very positive for the sector. Moreover, although it is not directly stated in the report, it is acknowledged that cryptocurrencies create a much more effective financial infrastructure, and it is emphasized why a decentralized system is valuable, which is invaluable in terms of showing that the IMF has been approaching the principles of cryptocurrency.

Prepared by: Berkay Aybey

The opinions and comments expressed herein are those of BV Crypto. BV Crypto shall not be held responsible for any financial transaction based on this article. As every investment and trade action involve risks, we recommend that you conduct your own research when making such decisions.