Crypto Market After Halving And What To Expect In The Future

HALVING DYNAMICS AND PRICE EXPECTATIONS

We know that the halving effect has positively affected the Bitcoin price after the halvings in 2012 and 2016. We will examine the reasons for these increase trends and the days after 2020 halving through the definition of bitcoin inflation, the impact of miners, the global economic condition.

1- Inflation

Thanks to Halving, Bitcoin inflation decreases by 50% every 4 years. As the amount of decrease is determined proportionally, we see that the amount of decrease gradually declines. Looking at the 2 halvings that took place before, the amount of reward decreased from 50 BTC to 25 BTC in 2012 and from 25 BTC to 12.5 BTC in 2016. For this reason, the uptrend in bitcoin price is expected to continue similarly to the previous halvings in order for the reward amount, which will be 6.25 BTC in 2020 and 3.125 BTC in 2024, to be satisfactory.

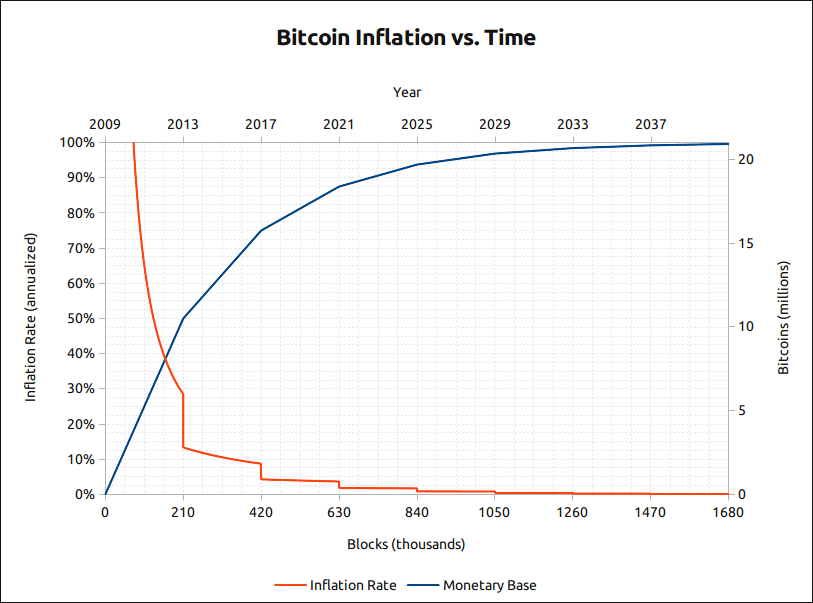

From the above chart, we can follow the view of Bitcoin inflation (orange) over time. In the chart, we see that the decrease in the reward ratio will gradually become minimal after the halvings that will take place in 2024 and 2028. Especially after the halving, that will take place in 2032, we can say that the effect of halving on Bitcoin price will stabilize as the reward amount will fall below 1 BTC. Therefore, the positive effect of the halvings in 2020–2024–2028–2032 on Bitcoin price is expected to increasingly continue. After a nearly 12-year period, the price that Bitcoin will reach should be at a high enough level to make a profit to miners after 2032 as well.

After 2032, as the increase in Bitcoin supply will continue with a very small rate, the effect of demand for Bitcoin on the price is expected to gradually increase.

2- Miners

With the changes it has undergone over time, the mining sector now has more advanced mining devices, and it works in groups. This structure, which we call a mining pool, also ensures a reduction in costs by directing individual miners or companies to work in groups. For this reason, we can classify the miners as companies with high economic value and corporate companies.

The mining pools we mentioned have taken various precautions for halving. They reduced their pre-halving costs by modernizing their mining devices and doing more efficient mining with less electricity. If the price ranges between $7.000- $8.000 after the halving, miners will continue to share the $6–8 million income per day. Therefore, we can see that the expected increase for miners to profit is not an emergency case. To this respect, the expectation of increase, which we have examined under the ‘inflation’ title, is considered to be based more on the trend rather than a rapid and sharp increase.

Additionally, in case the mining companies turn off their devices for various economic reasons such as coronavirus, mining will be easier because the competition/hashrate in the Bitcoin network will decrease. Reduction of difficulty level can make individual mining profitable again and fill the gap to be formed. We can say that this supports the trend-based increase idea we mentioned above.

3- Global Economy

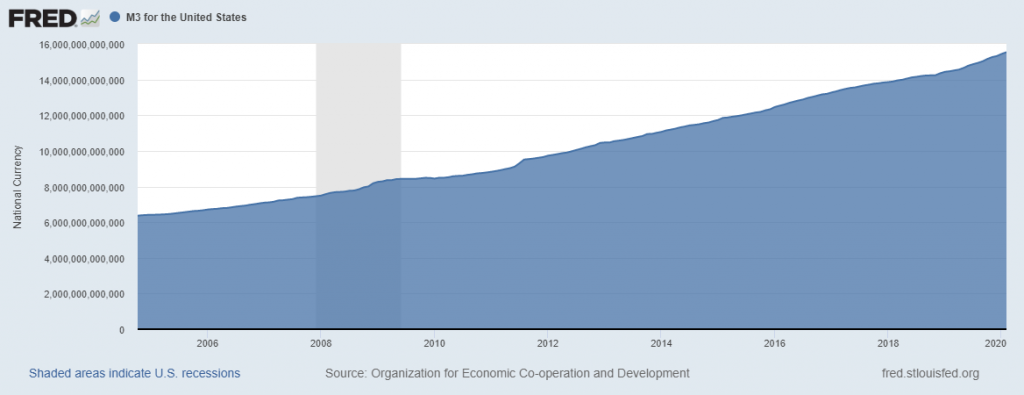

The increasing continuation of dollar-based monetary expansion gradually makes the stores of value with limited reserves like Bitcoin more attractive. Similar to the sharp increase in monetary expansion after 2008, we face the same situation in 2020 due to the coronavirus.

The fact that the 2012 and 2016 halvings took place in the recovery period after the 2008 crisis also made the factors we mentioned under the ‘inflation’ and ‘mining’ titles much more effective on the Bitcoin price.

Today, although the monetary expansion continues with a sharper increase than ever, the low economic appetite due to the virus indicates that the effects of 2020 halving may differ from the previous ones.

An aggressive increase in global consumption can be expected, when life begins to normalize with precautions like quarantine ease over time. Two examples of above are; with the easing of the lockdowns, luxury shops in China selling products worth millions of dollars in one day, and the queues experienced in the shopping malls in Turkey.

As the consumption will rapidly increase, it can be expected that the markets will gradually normalize and gain value accordingly.

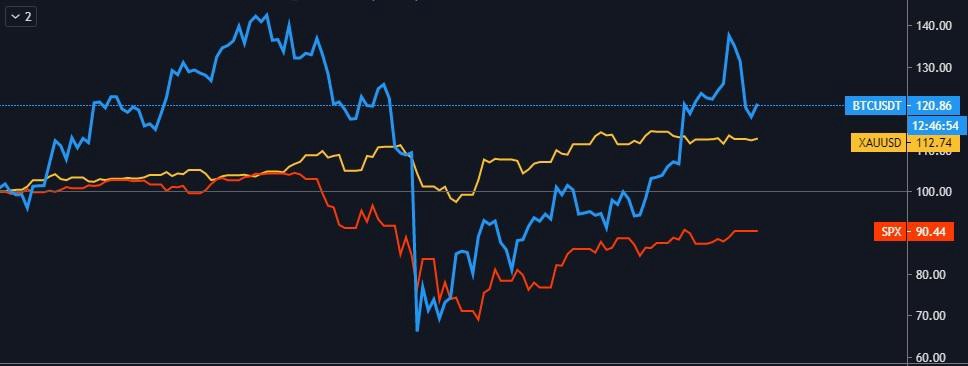

It will not be a surprise that Bitcoin, which demonstrates similar behaviors with stock market indexes, maintains its superior status with the halving advantage it has. In the chart below, we see the performance of the BTC (blue) — Gold (Yellow) — S&P (red) indexes since the beginning of the year.

The recovery we saw above is highly dependent on the behavior of Bitcoin investors as well as on the halving.

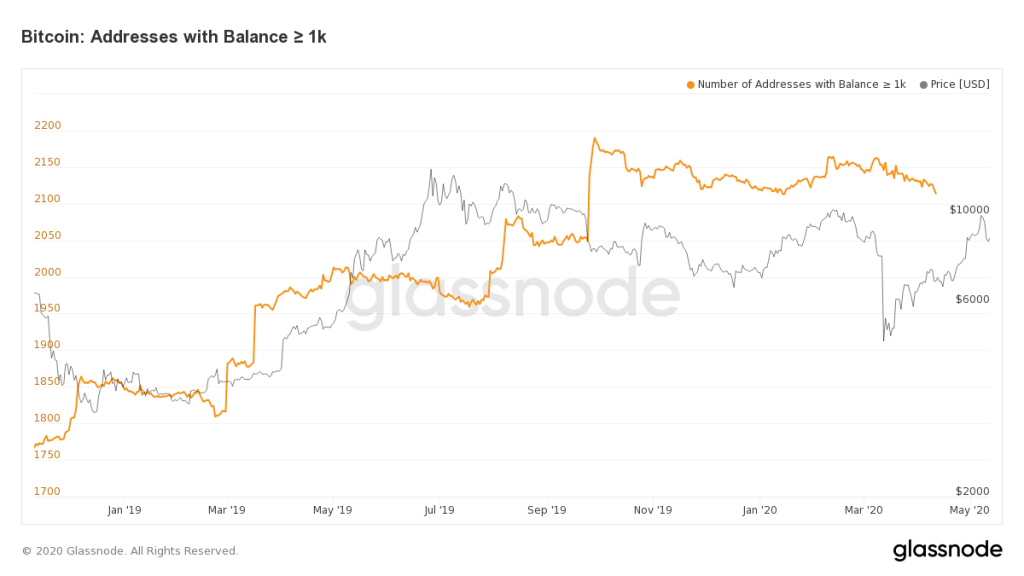

In the chart below, we see that users having more than 1.000 Bitcoins (orange) continue to hold their Bitcoins. Since these wallets contain high amounts, it is possible to say that the trust of investors in Bitcoin progresses in a positive direction in their long-term investment preferences.

In conclusion, systematic motives such as inflation-based mathematical motives, Bitcoin price that miners need to reach in order to make a profit in the long run, and the social motives introduced by a suppressed consumption appetite due to the crisis period we are in, show us that the expectation of an increase in Bitcoin price after halving is rational on various grounds.

It is estimated that the expectation of an increase will cover a trend segment of nearly 12 years until the halving in 2032 in the long-term. Then the increase in demand is estimated to have a direct impact on the increase in price.

As for the medium-term expectations, with the abolition of virus-based precautionary measures, both the impact of the suppressed demand expected in consumption and investment and the expectation that the money printed by the central banks in this period will return to the financial markets again as it did after the 2008 crisis, points out that Bitcoin can enter into the increasing trend as in the previous halvings.

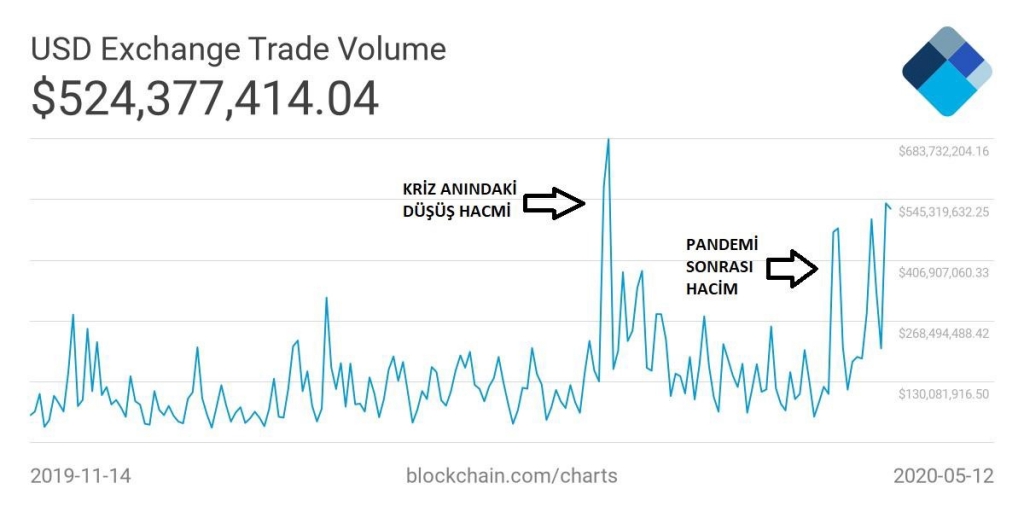

The chart below shows the volume of Bitcoin transactions before and after the pandemic. Based on this chart, we can see that the volume of Bitcoin trade has already increased above the level before the virus, although the measures against the virus have just begun to ease.

In addition, in case the expected virus-based 2nd and 3rd wave impacts become a reality, medium-term expectations may need to be updated again.