Story of Game of Thrones: Bitmain

Bitmain, one of the largest cryptocurrency mining companies in the world, has been the subject of a war between company executives for more than 1 year. Bitmain, where the management war was waged, posed an undeniable threat to the market due to its substantial size in the mining market. The biggest reason for this is that Bitmain is the manufacturer of the most popular mining device, Antminer.

You can find, in this article, a detailed explanation of what happened in the Bitmain crisis, which was resolved at the beginning of 2021 and how it affected the company.

Bitmain was founded in 2013 by Micree Zhan and Jihan Wu. These people will be mentioned in the rest of the article with their surnames.

Part 1. Wu’s Move

- The first signal of steps parties will take against each other to gain control of Bitmain came from a Chinese media outlet on November 12, 2018. The news reported that Zhan and a few other executives had been stripped of their management rights and voting rights in Bitmain.

Under Chinese law, such changes within the company are not required to be disclosed. Bitmain was in the IPO process with the Hong Kong Stock Exchange at the time, but its application had not yet been approved. Therefore, the company did not have an obligation to inform the public. Consequently, the news content could not be verified and remained as gossip.

- Subsequently, Bitmain announced that the management change was made not in the main company, but at Bitmain Technologies Holding Company, one of the Beijing-based parent companies, and Zhan was appointed from the chairman of the board to the position of manager. Bitmain stated that this change was made within the framework of some legal regulations that the company must comply with during the public offering process, and that Bitmain is still managed by Zhan and Wu.

(Although the Beijing-based company is Bitmain’s main operations center, it is mostly responsible for managing its operations in China.)

- On October 29, 2019, Wu sent an e-mail to all Bitmain employees. Mail stated that all duties and rights of Zhan within the company were terminated, that the employees should not comply with any directives from Zhan, and that the contract of those who comply would be suspended.

- Zhan, who was out of town, returned to Beijing the same day after the mail, but was denied entry to the company building.

- After the mail, to notify the state about the management change, Bitmain sent the documents containing the changes. In the documents, it was stated that Zhan’s duties were taken over by Wu.

- Wu said at the meeting in the Cayman Islands, where the decision was made, that their disagreement with Zhan has been going on since 2015.

Part 2. Zhan’s Counter-Attack

- On December 13, 2019, Zhan sued the main company Bitmain in the Cayman Islands to regain control.

At this point, it is necessary to talk about Bitmain’s company structure and voting rights. Bitmain shares are divided into series A and series B. Series A shares provide 1 vote per share, while series B shares provide 10 votes per share. Although the total number of series B shares is unknown, Zhan is the largest series B shareholder with 3.9 billion shares, while Wu is ranked 2nd with 2.2 billion series B shares. The two names are estimated to own the majority or all of the series B shares. Therefore, it is clearly evident that Zhan alone has a substantial voting right.

According to Bitmain’s bylaws, decisions in the board of directors are taken with 2 different consensus methods as “ordinary resolution” or “special resolution”. Ordinary resolution method requires more than half of the board to approve the decision. Special resolution method requires the 2/3 majority of the board.

The decision at the meeting where Zhan’s authorities were revoked, was taken by special resolution method. Although the validity of this method was not possible due to the voting right that Zhan has, Wu held the meeting legally by benefiting from an article in the bylaws.

According to the bylaws, if the person or persons holding series B shares constitutes more than 1/3 of these shares, the meeting is qualified. Wu, who provided this qualification with his series B shares, ensured the legality of the meeting. However, bylaws also require that Zhan must be informed at least 5 days before the meeting. Zhan bases his lawsuit against the company on this article on the grounds that he has not received any information about the meeting.

- Bitmain’s IPO was suspended in December. The Hong Kong Stock Exchange did not approve the IPO based on doubts that the company’s revenue was not sustainable. At that time, the Bitcoin price saw $3,000 levels, reducing Bitmain’s profitability.

- On January 2, 2020, Zhan managed to cancel a decision taken by Wu with the lawsuit he filed. Wu wanted Luyao Liu, the company’s CFO, to head the Beijing-based Bitmain company. Zhan was previously in this position.

Although the court ordered the annulment of Wu’s decision, it also rejected Zhan’s request to be reinstated.

- Meanwhile, Zhan was still the legal representative of Beijing-based Bitmain company and many subsidiaries such as Fujian.

- In March, Zhan sued Fujian Zhanhua Intelligence Technologies, which handles Bitmain’s logistics operations in China. Showing his shares as evidence, Zhan froze his rights over this company, which is affiliated with Bitmain, with a court decision. Fujian is one of the key companies for Bitmain’s income from China.

- Bitmain announced on April 28, 2020 that it will begin receiving orders and payments for mining tools through Chongqing Guiyan, not Fujian. The Guiyan company is a subsidiary company affiliated to Bitmain’s Hong Kong office, which is controlled by Wu.

- On May 27, 2020, Zhan published a document for the firing of CFO Luyao Liu, whom Wu previously wanted to put in his position.

- Bitmain shared the company’s authorized seal and its serial number through its WeChat account by sending a reminder message to its employees, declaring that no directives of Zhan should be followed. Seals without this serial number were asked to be ignored. The seal was in Luyao Liu as of that moment.

- Zhan sent a letter to the company employees via WeChat. In the letter, it was stated that as of June 3, Zhan will return to his position at the Beijing-based Bitmain office. Employees of the company were asked to work in the office rather than home, to accept Zhan as their manager, and to meet under Zhan’s future goals for the company.

- On June 3, 2020, Zhan broke into Bitmain’s Beijing office with a crowded private security team. After this attempt, which resembled movie scenes, Zhan took control of the building.

- After Zhan took over control of the office on June 3, he distributed bonuses of $1,500 and $750 to employees in the company. Employees were put in a difficult situation by being required to came to the office during the pandemic.

- A message shared from Bitmain’s WeChat account stated that the last shared seal and serial code were invalid. The last code belonged to CFO Luyao. Accordingly, it was understood that Zhan took control of the company’s WeChat account along with the control of the office.

- The official Bitmain website claimed that the company’s WeChat account had some technical problems and that all the posts were fake, requested they should be ignored. The company also stated that a lawsuit will be filed against Zhan for forging the seal.

- Bitmain, in a statement issued on its WeChat account, demanded that all company employees stop working from home and continue their work at the Beijing office. It was also stated that only the salaries of those who worked for at least 13 days in June in the company will be paid.

- On June 22, 2020, Zhan wanted to settle down by offering Wu and other shareholders to sell their shares for $4 billion.

Distribution of Bitmain shares on that date:

Zhan: 36%

Wu: 20%

3 investors: 15%

Employee share pool: 19%

External investors: 10%

The $4 billion offer to Wu and 3 investors is not only for a 35% stake in the company, but for regaining control of the entire company. Therefore, it can be said that 19% owned by the company is also wanted to be purchased with the offer of $4 billion.

Considering that the estimated valuation of the company before the public offering is $14.5 billion, the offer appears quite low. This offer could be interpreted as a kind of challenge, a generous offer made by Zhan to speed things up, confident that he will win the case.

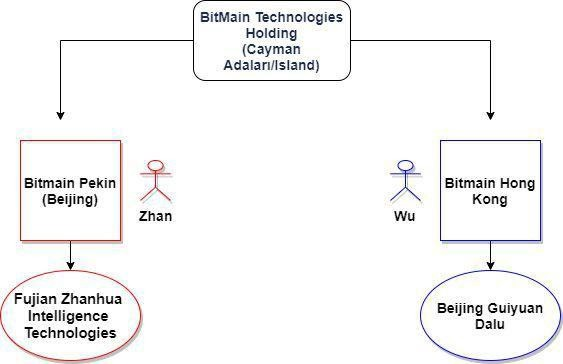

The diagram below will help you to see the process up to this point and how the company was divided in the simplest and clearest terms.

Part 3. Division

As seen in the above diagram, Bitmain company is divided into two as Beijing office, which is the operation center, and Hong Kong office, which deals with the company’s international sales. The parent company in the Cayman Islands is located on Wu’s side.

- Zhan announced that the company’s Hong Kong branch stopped providing chips for mining tools.

- While Bitmain Hong Kong confirmed this statement, it turned out that the two companies actually stopped sending products to each other.

- When Zhan took control of the Beijing office, he deprived the Hong Kong office of the entire logistics and storage network connected to the Beijing office.

- As a result, the Beijing office was unable to manufacture new products without chips, and the Hong Kong office was unable to distribute these products.

- Zhan published a letter stating that even if the company lose money, they will obtain the chips from another company. The letter also emphasized that Wu removed Zhan from the company unlawfully.

- While Zhan was trying to solve the chip problem, and Wu was trying to solve the logistics problem, the estimated delivery date of the products that the company has to deliver in June-July has been postponed to September-October.

- Due to the high demand for Bitmain’s mining tools, ordering these devices must be applied in advance. For this reason, customers have paid in March-April for the order of the products that are expected to be delivered in June-July. As a result, it can be said that the waiting period is significantly prolonged due to the delay of the delivery date.

- Bitmain therefore offered 2 options to its customers.

1st option: Customers must submit their formal request to Bitmain for speeding up orders. Customers will be able to get their money back if Bitmain fails to deliver the products within 60 days of the official request letter.

2nd option: Customers will wait for Bitmain to ship the products and will not make any requests. Bitmain promised to provide customers who choose option 2 with an amount of vouchers equal to the amount of profit that would be made during the delay in the order. Vouchers could be used for the subsequent product purchases.

- In July 2020, it was reported that 10,000 Antminer tools were stolen from Bitmain’s mining farm in China’s Inner Mongolia Region. Although these tools were owned by the customers, they were operated by Bitmain at the customer’s preference.

Zhan claimed that, through former Bitmain employees, the tools were taken by Wu into companies under his control.

Thus, the management battle at Bitmain, first unsettled the investors, then caused the employees to choose sides. In particular, calls for employees to continue working in the company, not at home, may have seriously endangered the health of employees during the peak of the pandemic period. Finally, as customers are also clearly affected by this struggle, it is evident that Bitmain company has suffered from this power struggle with all its formations from its investors to its employees and customers.

Part 4. Settlement

- On September 14, 2020, Jihan Wu succeeded in getting the document specifying the management level of the company approved by the official institutions. With the approval of this document, Wu officially became the director and legal representative of Bitmain’s Beijing office. Zhan was appointed as the general manager.

- After this decision, Wu announced that he will work to permanently compensate the damages of investors, employees and customers who were damaged by the management war.

- On January 26, 2021, Wu and Zhan reached an agreement.

In accordance with the terms of the agreement, Wu announced that he would resign from all his posts at Bitmain. Thus, Zhan took full control of Bitmain. Wu, who left Bitmain, became the head of the Bitdeer and BTC.com mining pool, which were mining in Norway and the US, according to the agreement.

- With the agreement, the war that lasted for almost 2 years came to an end, and Bitmain regained its old functioning. As can be guessed, Bitmain’s main competitors Canaan and Ebang increased their market shares during this period.

- Due to the high demand in the mining market, Bitmain did not have a hard time in its return. Deliveries for the company’s sales from May to August have already been completed.

- In order to meet the high demand, the company follows a policy of making high increases in mining tool prices in each sales period.

- During the management war of Bitmain; Ebang and Canaan went public and completed their investment collection process. Bitmain was late in this area. Therefore, one of Zhan’s first actions could be to complete the IPO process of Bitmain.

Device manufacturing companies like Bitmain are critical not only for Bitcoin but for all cryptocurrencies mined. These companies do not have many competitors in terms of the quality of the products they produce. Management war, as experienced by Bitmain, or delivery disruptions for different reasons can negatively impact the mining industry. Therefore, although the reason that pushed Wu and Zhan to come to an agreement is not exactly known, the solution of the crisis in Bitmain without permanent damage to the company concerns not only Bitmain’s investors but also the entire cryptocurrency community, as it affects the mining industry.

Written by: Berkay Aybey

The opinions and comments expressed here belong to BV Crypto. BV Crypto cannot be held responsible for any financial transactions made on the basis of this post. Every investment and trading move involves risk. When making your decision, you should do your own research.