An Overview of the Liquidity Crisis through the Lead Actors: Celsius and 3AC

For many people, the scenario of Bitcoin falling below the level of USD 18,000 was quite unlikely. However, we must admit that this is not the first time that Bitcoin has experienced such sharp rises and falls, and we witness a rise or fall beyond expectations in each case.

In periods when the market rises, the investment appetite increases and various projects emerge accordingly. Nonetheless, how much of these projects are actually based on a sustainable idea or how well they are managed becomes evident in periods when the market falls. In short, high-quality and poor-quality projects in the market are indeed differentiated from each other in periods of falls.

We have been experiencing a similar case in the current decline trend now. Just as there was a different story that triggered each upward trend, we encounter different stories towards the end of each downward trend. For instance, the latest upward trend, which was led by the DeFi and NFT, was different from the previous upward trend. It is because even the formation of a sector such as NFT was not very predictable until 2–3 years ago. The fact that innovations such as NFT can reach the market size of tens of billions of dollars very quickly has enabled investment companies to allocate larger amounts to cryptocurrencies. As a result, a different story emerged again, and perhaps for the first time, well-managed and poorly-managed investment companies in the cryptocurrency market began to diverge.

The liquidity crises faced by Celsius and Three Arrows Capital (3AC) have been on the agenda for days since both companies manage funds of a size of billions of dollars. We have scrutinized these two companies’ processes for you since they have been indicated to be the cause of the sharp decline in the market particularly after the Luna crisis.

stETH

Before describing the details of the process, we should provide preliminary information about the stETH token. If you already have information about this token, you can proceed directly to the next heading.

With a process known as ETH 2.0 or Merge, the Ethereum network entered a new mining system and a complete reorganization process. Those wishing to join the new mining system need to lock a minimum of 32 ETH into the network. Now, the locked amount cannot be withdrawn to the wallets. After the network is fully upgraded to the new system and the next update is made (in an estimated period of 1 year), the locked ETH balances will be able to be withdrawn into the wallets.

The Lido platform created the stETH token to both simplify the locking process and ensure that the locked amount can be withdrawn at any time. When you prefer to lock ETH through the Lido Instead of locking ETH directly into the Ethereum network, the Lido does the locking for you and gives you a stETH token in return. That is, 1 stETH = 1 ETH + staking reward to be earned due to locking. When the locked ETH balances become withdrawable to wallets, you can exchange the stETH tokens in your balance for the original ETH tokens.

The stETH-ETH pool, which was created on the curve platform, has the most liquidity and you can trade this token in this pool. That is, it is a parity by which you can convert the tokens you have locked into Ethereum blockchain without waiting for the developments.

Now, in the light of this information, we can describe the processes experienced by Celsius and 3AC.

Celsius

With its 1.7 million users, Celsius is a financial organization that provides banking services in the cryptocurrency market. After the devaluation of the Luna and UST tokens, Celsius and 3AC, which could not manage their cash balance well, experienced a liquidity crisis as a result of both users’ loss of investments and demanding to withdraw their money in a panic.

The withdrawal requests reached such a level that Celsius announced that it had stopped the withdrawals. This was not because Celsius lost the majority of its funds, but because most of its assets were in a locked position because of its investments. In other words, it had few resources to convert into cash and pay the users.

One of the factors that triggered the liquidity crisis is the hacking of two DeFi platforms that Celsius invested in. It is stated that Celsius lost ETH worth about USD 120 million due to the hacking of BadgerDAO and Stakehound.

Celsius, which has a balance of 500 million UST, is one of the significant wallets that triggered the decline of UST. Celsius, which sold its balance suddenly and heavily, harmed the stability of the UST. However, it has been one of the rare companies that have achieved to overcome the UST crisis almost without loss. How did it happen?

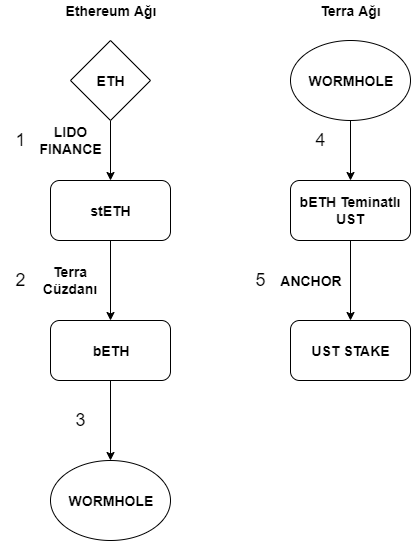

While Celsius wanted to benefit from the higher interest rate offered for UST on Anchor, it did not perform transactions by directly buying UST from the market. Instead, it used its ETH balances.

- The ETH balance allocated for 500 million UST was first converted into stETH tokens through Lido. We already mentioned how this token was obtained.

- Then, the stETH balance was converted once again to bETH through Terra’s vault on the Ethereum network to buy bETH, which is the accepted ETH type on the Terra network.

At this point, you can ask why the ETH balance was not directly converted into bETH. The reason for this is that they desired to obtain a staking reward by staking ETH over Lido. In the case of direct conversion, they would earn no staking income. - The obtained bETH tokens had to be sent from the Ethereum network to the Terra network. The Wormhole platform was used for this transaction.

- They transferred the bETH balance to the Terra network through Wormhole and used it as collateral to buy UST in return.

- The UST balance was sent to the Anchor platform and locked in to generate higher interest income.

So, how could Celsius achieve to withdraw its money without any loss when the stabilization of the UST failed?

Since Celsius bought UST using bETH collateral, it was sufficient for them to get back its collateral. In other words, it had to reimburse the borrowed UST + interest. Therefore, it did not matter whether the UST was equal to 1 USD or not, the amount of UST to be reimbursed was important. The USTs, which were locked to Anchor, were withdrawn from the platform and the loan was paid and the BETH collateral was taken back. Then, the bETH tokens were converted to the stETH tokens following the process in the diagram in the reverse order.

ETH tokens, which were locked into the Lido initially, could not be withdrawn as Ethereum’s new network was not fully operational. Therefore, Celsius used the stETH-ETH pool on the Curve platform to convert the stETH tokens back to ETH. However, the size of this pool was not deep enough for everyone. The pool lost its stability due to the fact that companies such as Alameda Research, 3AC (we will mention later), and Celsius wanted to sell their stETH tokens in large amounts in the same period. After selling, the amount of stETH in the pool became more than 4-fold the ETH amount. In other words, although there was much stETH in the pool, there was not enough ETH for everyone. Thus, Celsius became unable to meet users’ ETH withdrawal demands because it did not have enough ETH.

Although Celsius survived the UST crisis, it has been still negatively affected by the panic caused by this crisis. The company’s plans to generate cash using the stETH-ETH pool in case of need did not work out because there was huge selling pressure in the market. Therefore, it could be said that Celsius did not perform a proper risk distribution by using the majority of the ETH balance for investment.

Celsius’ liquidity crisis has not ended here… The company, which locked its BTC balance to MakerDAO as collateral to create cash, received DAI worth USD 278 million in return and used it for cash needs. However, due to the sharp declines in the Bitcoin price, the coverage rate of BTCs given as collateral has been gradually decreasing. When the loan was first received, Celsius was at risk of losing all of its collateral in case of the decline of BTC price to around USD 20,000. Fortunately, it managed to reduce this level to around USD 13,600 by adding additional collateral. In other words, the collateral of Celsius will be safe if the BTC price does not decline to the level of USD 13,600.

As of June 20, the withdrawal transaction was still closed at Celsius. It is reported that the company has begun to receive consultancy on the issue from large companies such as the Citi Group.

Three Arrows Capital (3AC)

According to data from last April, 3AC, which used to manage funds of USD 3 billion, was one of the most prestigious investment companies in the crypto market. 3AC made a name for itself by early investing in the tokens of blockchains such as Ethereum, Solana, and Avalanche, which are among the largest and most well-known blockchain projects in the market. An overview of the companies in 3AC’s portfolio reveals that they are all well-known, important platforms and infrastructures.

Therefore, 3AC’s investment in a company indicated that the future of the company was quite promising. However, this reputation of 3AC can be said to be quite far from its previous days due to the aggressive trade strategy of the company.

3AC’s liquidity crisis came to light when the company failed to repay its loan of USD 400 million and forfeited its collateral. The fact that a large company such as 3AC could not add additional collateral to its loan revealed that there was a serious cash shortage. Since the company experiencing the crisis was 3AC, the interest and agenda of the whole market turned to the transactions, loans, and balances of 3AC.

Research has revealed that 3AC suffered a huge loss due to its investments in Luna and UST. The company’s Luna investment of USD 559 million is worth only USD 670 now. It is also estimated that 3AC has lost a 9-digit figure, i.e. USD 1 billion or greater, due to UST.

It was also a matter of debate whether 3AC, which received loans of about USD 300 million from Compound and Aave platforms to solve its cash problem, could repay these loans. Because, if the cryptocurrency prices continue to decrease, the collateral given for these loans may not be able to meet the loan and be liquidated.

While the loans of 3AC were a topic on the agenda, Zu Shu, who was both the founder and the face/representative of 3AC in the market, did not deny the events by explaining that they were striving on the issue.

Similar to Celsius, 3AC also had a large amount of stETH. 3AC, which has aggressively sold stETH due to cash shortage, is another large company that has created selling pressure on the stETH/ETH parity on Curve. However, as we previously mentioned in the Celsius section, the instability of the pool led to selling stETH at a loss.

The comments of 8 Blocks Capital, which has been working with 3AC for a year and a half, have brought a different perspective on the issue. According to the agreement between 8 Blocks and 3AC, 8 Blocks will be able to transfer money to accounts traded by 3AC. 8 Blocks will get all the earnings. 8 Blocks would only pay the commission fee to 3AC. Apart from this, 3AC did not have the authority to use the money of 8 Blocks and transfer it to other accounts.

Although this agreement was carried out smoothly, 8 Blocks was unable to reach anyone at 3AC when it requested a withdrawal recently. The results of the investigations made by 8 Blocks, which was naturally annoyed and suspicious of this process, revealed that USD 1 million was transferred from 8 Blocks’ account to another account in violation of their agreement, and it was used to cover 3AC’s losses.

Along with this incident, it was stated that 3AC aggressively opened leveraged longs, i.e, it took position considering that the market will rise, to make up for the balance lost due to Luna, that these positions were also liquidated due to the decrease in the market, and that 3AC’s cash shortage got worse.

These claims were verified by the FTX, Deribit, and Bitmex authorities that confirmed that 3AC’s transactions were closed. It was even stated that 3AC owed USD 6 million to Bitmex after closing the positions. Therefore, it can be stated that 3AC resorted to more aggressive methods as it lost money, thus it lost more money.

On the Twitter profile of Zu Shu, the founder of the company, there were tags of tokens in his portfolio. After the cash crisis, Zu Shu removed these symbols from his profile, suggesting that the company may have sold the altcoins in its portfolio to generate cash.

According to the recent statements from 3AC, the company has been still seeking a solution, discussing various proposals such as the sale of the assets owned by the company, or the sale of 3AC to another company.

Manipulation Claims

Above, we have seen how serious a cash crisis the two major companies have been experiencing. This incident brought about important claims about the market. The most significant of these claims was that other companies competing with Celsius and 3AC, or those who would somehow get profit from the bankruptcy of these two companies, deliberately lowered the market. It is because the decline in the cryptocurrency prices gradually devaluates the collateral of the loans taken over DeFi platforms and leads to the liquidity of the loan. Therefore, the liquidation of the loans of Celsius and 3AC causes these companies to lose their long-term investments due to the loans they received to meet their short-term cash needs.

In case of liquidation of a loan, the collateral cryptocurrency is sold and the loan amount is returned to the platform’s account. Let us join up the dots now… We should include the borrowers from the DeFi platform in addition to 3AC and Celsius. These loans (if no additional collateral is deposited) will be liquidated as a result of the market maker’s deliberate manipulation of prices, that is, lowering the prices. When DeFi platforms sell the cryptocurrencies they receive as collateral, the selling pressure in the market will increase and this will facilitate the job of the market maker. With the release of tokens in the balances of the major investors such as 3AC and Celsius to the market, competing companies can add 3AC and Celsius positions to their portfolios at much cheaper prices.

Since such a strategy is possible, the manipulation claims should also be carefully monitored.

Do the stETH Sales Damage Ethereum?

stETH tokens, which face excessive selling pressure due to cash shortages, are almost unlikely to damage Ethereum. Since the stETH/ETH pool, which has become unstable due to selling pressure, offers a very attractive arbitrage opportunity, the current selling pressure is not expected to remain strong for long.

The current instability in the stETH/ETH pool causes the stETH to be sold at a discount of about 3%. In other words, 1.03 stETH can be bought for 1 ETH. Thus, when the new Ethereum network is fully operational, 1 ETH + staking income + 3% arbitrage profit will be taken for each stETH token to be returned. Therefore, it is expected that arbitrage opportunities will be used when the crisis environment calms down.

Lido Finance produces stETH tokens; thanks to this service, it represents 32% of all ETH tokens locked into the new network. Considering the worst-case scenario, Lido may want to withdraw all its ETH balance from the network. Even in this case, the Ethereum network is not damaged. Because there is also a quota for the process of withdrawing the locked ETHs. Therefore, once the quota is filled, the rest will have to wait regardless of the number of exit requests. This system is designed to ensure the security of the Ethereum blockchain. Therefore, even if Lido wants to withdraw all ETHs, this process may take weeks or months. To conclude, the Ethereum network is quite unlikely to be directly damaged through stETH tokens even in the worst-case scenario.

Stress Testing

It can be stated that both companies want to take a low risk by aiming return on stable coins. Since the crisis created by the UST negatively affects even companies acting with a low-risk principle, it is not similar to any previous crisis. However, one issue is certain, the companies that put all the eggs in the same basket are punished sooner or later even if they are stable coins. These companies should have made their risk distributions better, and they should not have relied so much on the depth of the stETH pool. Ultimately, as also mentioned in the introduction of the article, the poorly managed and the well-managed companies are separated in each decline period, which ensures a healthy basis for the market.

Although the empty part of the glass indicates the credit liquidations that trigger each other in a chain, the filled part of the glass reveals that DeFi platforms undergo an important stress test. Platforms such as MakerDAO, Aave, and Compound have proved that their systems operate in a healthy way even in the worst-case scenario, and their collateral rates are optimally adjusted. Hence, we should focus on the long-term gains that DeFi platforms will achieve through the lessons learned from such tests instead of short-term processes such as the cash crisis.

Prepared By: Berkay Aybey

The opinions and comments expressed here belong to BV Crypto. BV Crypto cannot be held responsible for any financial transactions made on the basis of this post. Every investment and trading move involves risk. When making your decision, you should do your own research.