Crypto In Coronavirus Crisis: Impact Of Stimulus Packages On World Markets And Bitcoin, April 2020

WORLD MARKETS BEFORE AND AFTER STIMULUS PACKAGES

In line with taking precautions against coronavirus, economic activities have either paused or slowed down around the world. Many countries have taken various measures regardless of their economic size in this crisis environment from which all the countries have been affected with no exception.

- How have these measures affected the European and US markets?

- What do these responses mean?

- What are the similarities with the previous crises?

- How did Bitcoin respond?

- What is the financial markets’ point of view to Bitcoin during its first global crisis test?

- What is waiting for Bitcoin in the future?

We will look for answers to these questions by examining the changes in the markets.

EUROPE

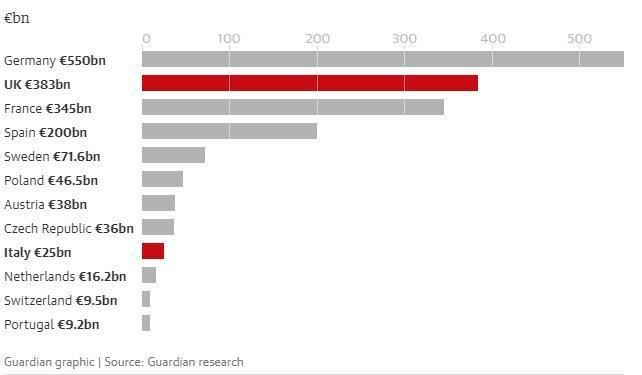

First, let’s look at the countries that announced the biggest stimulus packages in Europe.

As can be seen, although they were declared on different dates, Germany, UK, and France are in the first 3 places in terms of the size of the package. Therefore, examining the responses of the markets of these 3 countries will give us a reasonable idea for Europe.

The charts below show the responses of the FTSE (UK), DAX (Germany), CAC (France) markets after the announcement of stimulus packages, respectively. We observe that all three markets responded positively to these packages and entered a recovery process, albeit limited. Therefore, we can say that European countries have achieved the intended result at least for now.

US MARKETS

On the left, we can see that the S&P 500 index has been positively affected after the announcement of the $2 trillion stimulus package on March 26. Together with the measures taken by the FED, this package, which includes providing direct aid to both citizens and companies in addition to the precautions taken before, has caused positive pricing in the markets. In this regard, we can say that the US markets showed similar behaviors with European markets.

We can see that the yield of 10-year treasury note has calmed down after March 26, however, it seems that it has not been recovering similar to the markets.

As a result, we can say for both Europe and the US that the panic atmosphere in the markets has ceased, and the normalization has begun with the announcement of the stimulus packages.

SIMILARITIES

The market responses mentioned above reflect short-term responses. The expansionary monetary policies used in preparing the above-mentioned stimulus packages and the expectations for recession experienced in previous crises will provide us with a longer-term perspective.

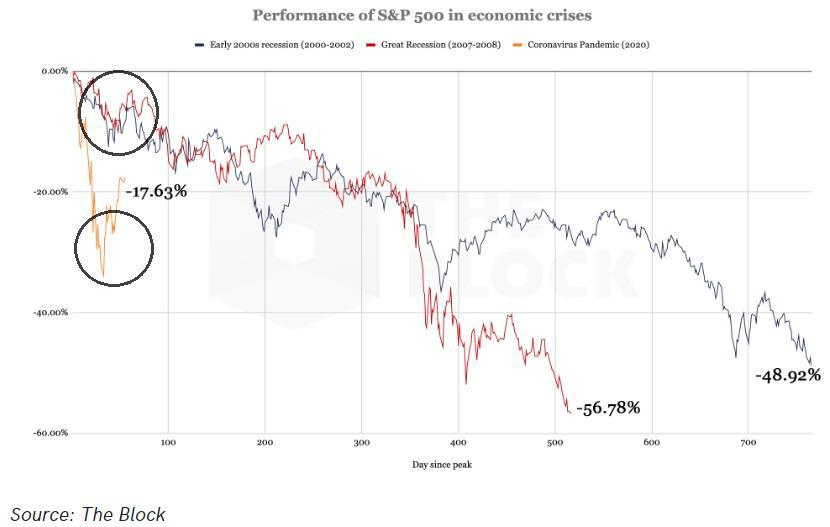

The performance of S&P, which represents the US market, in the 2000–2002 crisis (blue) and the 2008 crisis (red) is compared with its performance in the current crisis (yellow) in the chart above. As can be seen from the chart, the peak of the downturn process of the market is experienced in the next year or years after the crisis begins. Also, examining the area marked with an ellipse on the chart, we see that short-term rises, similar to the current recovery, have been experienced also during the previous crises. Therefore, it is difficult to say that the current recovery could provide long-term positive data. Similar to previous crises, the markets may take time to rise again.

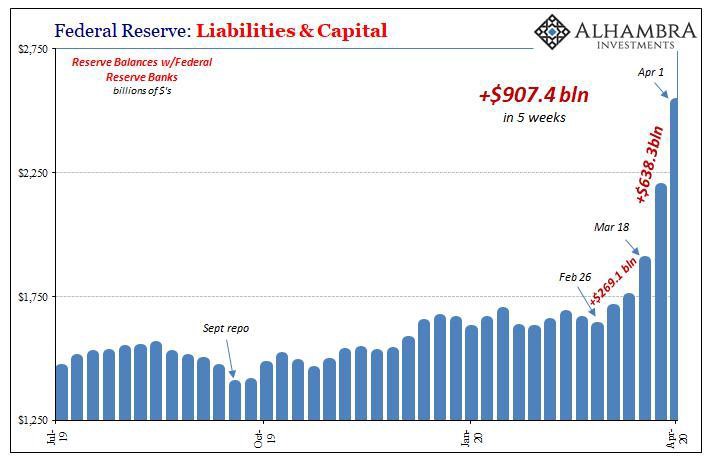

Considering the balance sheet of the Federal Reserve (FED), we see that monetary expansion has been experiencing a sharp rise as of April. As a result of this probable rise during the crisis, it will not be a surprise that the US Dollar continues to depreciate.

RESPONSE OF BITCOIN

The requirement of meeting urgent demands along with the panic atmosphere during the current crisis increases people’s needs for cash, however, our adaptation process has been improving as can be seen in the short-term recoveries at the beginning of our article. It can be expected that the foundation of people’s financial preferences shifts from urgent demands to protecting purchasing power in line with the gradual normalization of the current situation. In this case, Gold and Bitcoin, which have similar systems, stand out as a store of value.

The gold price chart on the left is rising as a store of value in today’s crisis environment, where money supply is provided aggressively. On the other hand, the chart on the right shows that the recovery in Bitcoin is not aggressive.

It would not be wrong to say that Bitcoin is now seen as an investment tool rather than a store of value. The fact that the recovery seen in the price chart is similar to the stock markets of the countries seems to confirm this.

MARKETS’ PERCEPTION OF BITCOIN

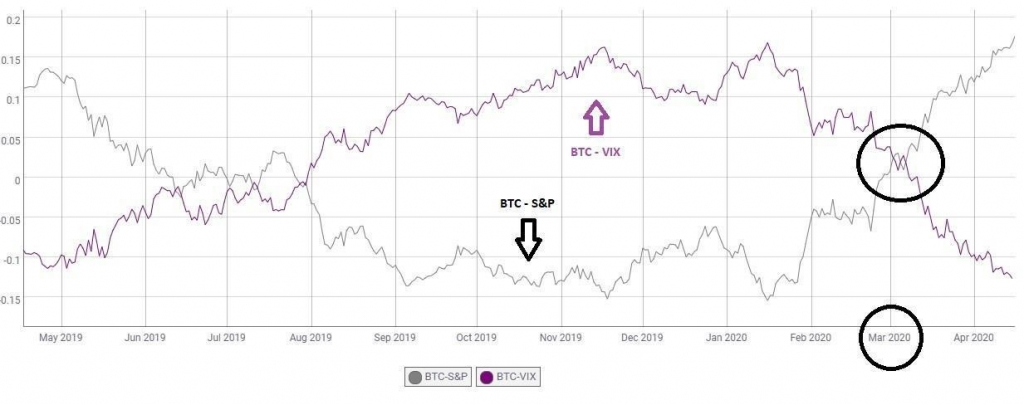

The chart above will help explain the above-mentioned behavior of Bitcoin. The chart shows BTC’s correlations (similar behavior) with VIX* and S&P. Examining the marked area, we can see that the correlation of Bitcoin has changed with the beginning of the crisis.

While the price movements show similar behaviors with S&P, it has a negative correlation with VIX, which is also known as the fear index in the market. This situation confirms that Bitcoin is not a preferred safe-haven when the uneasiness/fear atmosphere prevailing in the markets rises, but is seen as an investment tool like S&P.

WHAT IS WAITING FOR BITCOIN IN THE FUTURE?

Considering all these relationships, we can see that Bitcoin needs time to take over Gold’s position. However, the fact that the features of Bitcoin are different from Gold cannot be shown as the reason for this situation.

The features of Bitcoin as a “value of store” are quite similar to Gold. However, it may lead to such results since Bitcoin has been still a new currency, and also it has not yet had the overall validity of Gold.

Considering the reason for the demand for gold, we see that the limited supply and the inability to be imitated play the key role. For this reason, Bitcoin may attract long-term preferences, as the increase in the supply will drop by 50% in mid-May. This indicates that it is early to say whether the behavior of Bitcoin, which faces a global crisis for the first time, will be assessed in the same category as Gold or markets like S&P. Based on this idea, we can also say that Bitcoin has the potential to reverse the correlation seen in the last chart.

* = VIX, the Volatility Index, shows the level of fear in the market. If VIX is low, the level of fear in the market is also low. In this case, the market price is expected to rise.

If VIX is high, the level of uneasiness and fear atmosphere is also high, so there is a panic in the market.

This index is also known as the Fear Index.

We regularly share the latest developments in the cryptocurrency markets and the assessments made by our analysis team through our Medium, Twitter, and LinkedIn accounts. Do not forget to follow us to take your place in the new economy.